| Sl. | Products | Period | Repayment Rate | Loan Size |

| 1. | Dairy | 12-36 months | 26% reducing | Rs 8,000-Rs 50,000 |

| 2. | Agriculture | 12-36 months | 26% reducing | Rs 8,000-Rs 50,000 |

| 3. | Infrastructure (sanitation, house repair and maintenance) | 12-36 months | 26% reducing | Rs 8,000-Rs 50,000 |

| 4. | Micro enterprise (Vegetable vending, carpet making, etc.) | 12-36 months | 26% reducing | Rs 8,000-Rs 50,000 |

| 5. | Services | 12-36 months | 26% reducing | Rs 8,000-Rs 50,000 |

| 6. | Education | 12-36 months | 26% reducing | Rs 10,000-Rs 50,000 |

Operational Details

| S.NO | PARTICULARS | Amount

(In Rupees) |

| 1 | Loan Disbursement Since 2006 | 307,920,300 |

| 2 | Members Disbursed Since 2006 | 25,803 |

| 3 | Loan Outstanding-as on March, 31st 2017 | 30,209,660.00 |

| 4 | Active Clients-as on March, 31st 2017 | 3252 |

| 5 | Disbursement FY 2016-17 | 4,37,02,900.00 |

| 6 | Groups-outreach-as on March, 31st 2017 | 15011 |

| 7 | Members-as on March, 31st 2017 | 7701 |

| 8 | Portfolio at Risk | 0.00 |

| 9 | Current Repayment Rate | 100% |

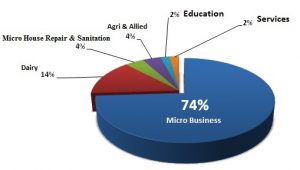

Sector-wise Clientele Profile